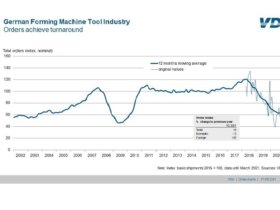

Turnaround for German forming technology

Orders received by the German metal forming technology manufacturers in the first quarter of 2021 were 9 per cent up on the previous year’s figure. Orders from Germany fell by 12 per cent. Foreign orders, however, were 25 per cent higher than in the previous year.

Orders received by the German metal forming technology manufacturers in the first quarter of 2021 were 9 per cent up on the previous year’s figure. Orders from Germany fell by 12 per cent. Foreign orders, however, were 25 per cent higher than in the previous year.

“For several months now, the industry has been registering improving sentiment among customers. This is now finally being reflected in the figures,” says Dr. Wilfried Schäfer, Executive Director of the VDW (German Machine Tool Builders’ Association) in Frankfurt am Main, commenting on the result. However, the low basis of the figures in the first quarter of 2020 was also part of the reason for the strong growth, as demand fell away sharply from March 2020 as a result of the pandemic. Comparison with the first quarter of 2019 therefore provides a more realistic picture. Here, the total orders are still 15 per cent below the level at that time, although foreign orders are 10 per cent higher.

Growth remains weaker compared to the machine tool industry as a whole, as the metal forming industry was still able to book a number of larger orders at the beginning of last year, especially from within Germany. “In the forming technology sector, major projects cause greater fluctuations than in the metal cutting sector,” says Schäfer, summing up.

The upward trend in foreign orders in the current year is primarily attributable to the non-euro economies. Here, China is driving the global economy forward and fuelling demand. It has been joined in this role by the new beacon of hope, the U.S. However, the recovery is relatively broad-based, as Europe is now also reviving. Many areas have a lot of catching up to do. The positive picture is completed by the capacity utilisation figure, which has risen from a low of 67 per cent last autumn to its current rate of 83 per cent.

Employment represents a delayed indicator of economic development, and is falling at present. In February, the machine tool industry employed around 7 per cent fewer people overall than in the previous year. This translated into 66,800 men and women. “This is a very moderate figure compared to the decline in production and orders. It shows how important it is for companies to retain their well-qualified staff. Short-time working was a great help here,” says Wilfried Schäfer.

Nevertheless, companies are struggling elsewhere. Bottlenecks in supplies are hampering production. In a recent pandemic survey, almost half of the machine tool manufacturers interviewed said they were experiencing serious problems with the supply of electronic components, especially controls. 46 per cent were having difficulties with steel and metal products. “Companies are already voicing fears of not being able to process orders on time because of the severe disruptions in the supply chain,” Schäfer reports.

The VDW expects production in the machine tool industry to grow by 6 per cent in the current year. The resulting volume of 12.9 billion euros is above that of the 2009/2010 financial crisis, but still far below the peak of 2019.