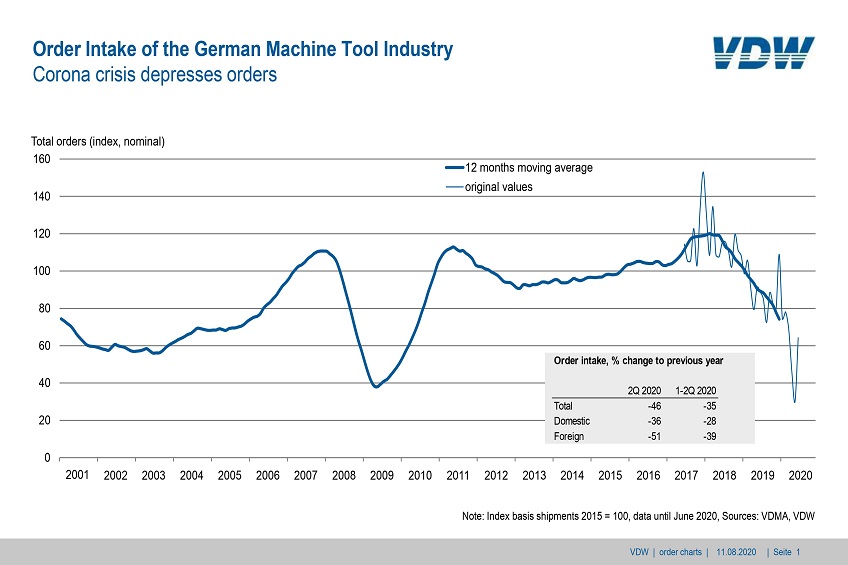

Corona crisis holding down German machine tool industry orders

Orders received by the German machine tool industry in the second quarter of 2020 were 46 per cent down on the same period last year. In the process orders from Germany fell by 36 per cent. 51 per cent fewer orders were received from abroad. In the first half of 2020, the level of orders fell by 35 per cent. Domestic orders were 28 per cent lower than in the previous year. The level of orders from abroad was reduced by 39 per cent.

“The second quarter figures clearly show the impact of the corona lockdown,” said Dr. Wilfried Schäfer, Executive Director of the VDW (Verein Deutscher Werkzeugmaschinenfabriken – German Machine Tool Builders’ Association), Frankfurt am Main, commenting on the results. Many customer sectors, especially the aviation and automotive industries, are experiencing sharp declines in sales and machine tool industry orders. Short time work, temporary production shutdowns and liquidity shortfalls are the consequences. Global investment activity nearly came to a virtual standstill during the hard lockdown phase. It is encouraging to note, however, that the downturn in the level of orders received now appears to have bottomed out. In June, there was a noticeable increase compared with the two previous months.

The two leading indicators – the PMI (Purchase Managers Index) and Ifo business climate index – are also providing more positive signals. In July, for the first time since the crisis began, the global PMI came very close to reaching the 50-point mark, which represents growth. The increase came as somewhat of a surprise and was broad-based, covering China, the US and the eurozone, including Germany, France and Italy. According to Ifo, the capital goods industry in Germany has raised its expectations. Retail sales are recovering, with industrial production and exports increasing again in June. This could herald the hoped-for recovery in the second half of the year, said Schäfer.

However, experience shows that it will take longer for this to filter through to the machine tool industry, which is a late-cycle capital goods sector. Accordingly, the industry’s expectations for the coming six months remain subdued. The latest sales figures and machine tool industry orders support this view. Sales in the first half of the year were 26 per cent down on the previous year.

Companies that are driven by digitalisation and 5G expansion and are working for the medical technology and electronics sectors, and for parts of the mechanical engineering sector, are in a slightly stronger position. “However, in all areas there are still great risks attached to a second wave of infection. This makes it is very difficult to state with any accuracy when international investment activity will stabilise,” says Schäfer. The companies are doing all they can to get through the crisis, pushing ahead with development and trying to hold on to their core workforce by furloughing them. The number of employees in May of this year was 3.7 per cent down on the previous year.

Downloads