International business bolsters German forming technology in 2023

USA supersedes China as strongest export market

Frankfurt am Main, February 23, 2024. – The production in German forming technology, one of the most important segments in the machine tool industry, declined in 2023 by a marginal 2 percent to around 2.3 billion euros. “This means that forming – which realizes its turnover in large-scale projects with automotive and other industries as well as with many smaller clients in the sheet metal machining sector – was almost able to maintain its output in spite of a slacking in demand,” commented Dr. Markus Heering, Executive Director of the German Machine Tool Builders’ Association (VDW). Domestic sales in particular have not escaped unscathed. They dropped by 15 percent, whereas exports bore up well with a plus of 8 percent. Heering is convinced that “An important contributory factor is investments by the automotive industry in key sales markets.” According to estimates by Oxford Economics, they should have risen internationally last year by 11 percent on a dollar basis and, calculated in euros, by 8 percent.

The prime export market in 2023 was the USA. With an increase amounting to 50 percent, it demonstrated robust growth. By contrast, the second most important market China was a disappointment with a slump of 15 percent. Poland (plus 62 percent), Italy (minus 25 percent), and Mexico (plus 16 percent) then followed well behind the leading two. “What we see here is a repetition of the pattern we already know from throughout the industry,” said Heering, continuing: “Regions such as North America and Eastern Europe, in which the vehicle industry is investing, provide impetus for forming technology from Germany. China, on the other hand, is struggling with weakening demand on account of consumer reticence and a real estate crisis. And in Italy, the generous tax depreciation options have petered out.”

The weak domestic demand in Germany is affecting domestic consumption and imports. Both are in decline, at rates of 13 and 8 percent respectively. By far the largest supplier is Switzerland, which nevertheless imported 9 percent less than in the previous year. In principle, supply interrelations within corporations are also a factor here. The USA also gained ground as regards imports with an increase in consignments of 260 percent. “What mostly lies behind this is deliveries by foreign companies with production in the USA, for there are only very few major US machine tool manufacturers still left,” Heering explained.

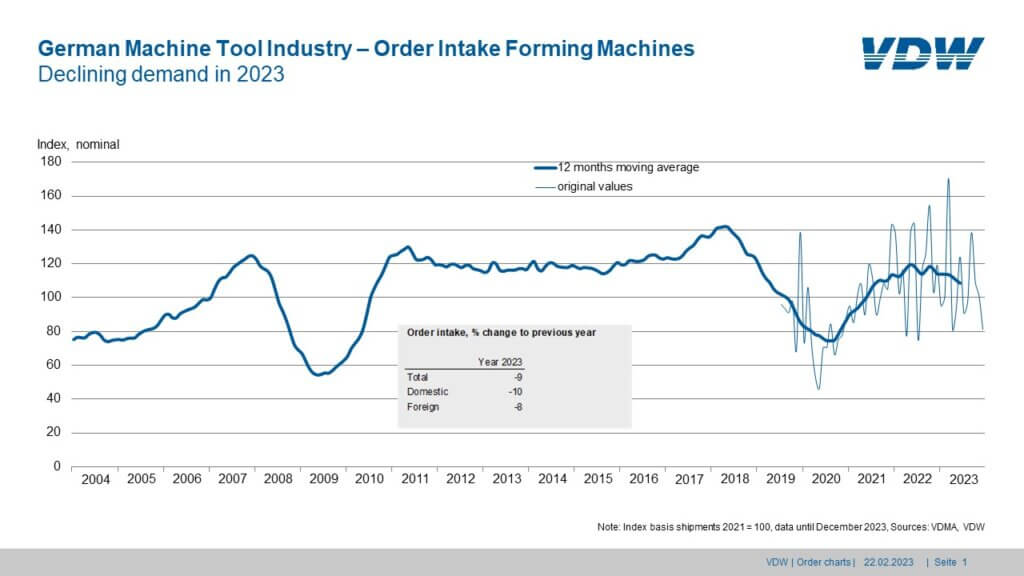

Incoming orders will further curb production in the present year. In overall terms, orders dropped by 9 percent. This meant a loss of one tenth on the domestic front, and 8 percent for overseas. “Positive expectations are especially directed towards growth sectors such as electromobility, battery production, wind power, medical engineering and rail technology, the aviation industry, and armaments. They more often plan their investments in the form of projects, from which the German forming technology can benefit,” Heering concluded.

Background

The German machine tool industry is one of the five largest trade branches within mechanical engineering. It supplies production technology for metalworking in all industrial fields and makes a major contribution towards innovation and advances in productivity in the industry. Given its absolute key role for industrial production, its development is an important indicator for the economic dynamics of the industry as a whole. In 2023, with an average workforce of around 65,200 (companies with more than 50 employees), the sector produced machines and services valued at around 15.2 billion euros. The share that forming technology had in this was one fourth.

Photo:

Dr. Markus Heering, Executive Director of the German Machine Tool Builders’ Association (VDW), Frankfurt am Main

Chart: Incoming orders for German forming technology

You can also access this press release directly at:

https://vdw.de/presse-oeffentlichkeit/pressemitteilungen/

Download

Charts and photos are also to be found online in the Press section of www.vdw.de. Follow VDW on its social media channels too:

www.youtube.com/metaltradefair

www.linkedin.com/company/vdw-frankfurt