Pay-per-stress – how do leasing partners get their money’s worth?

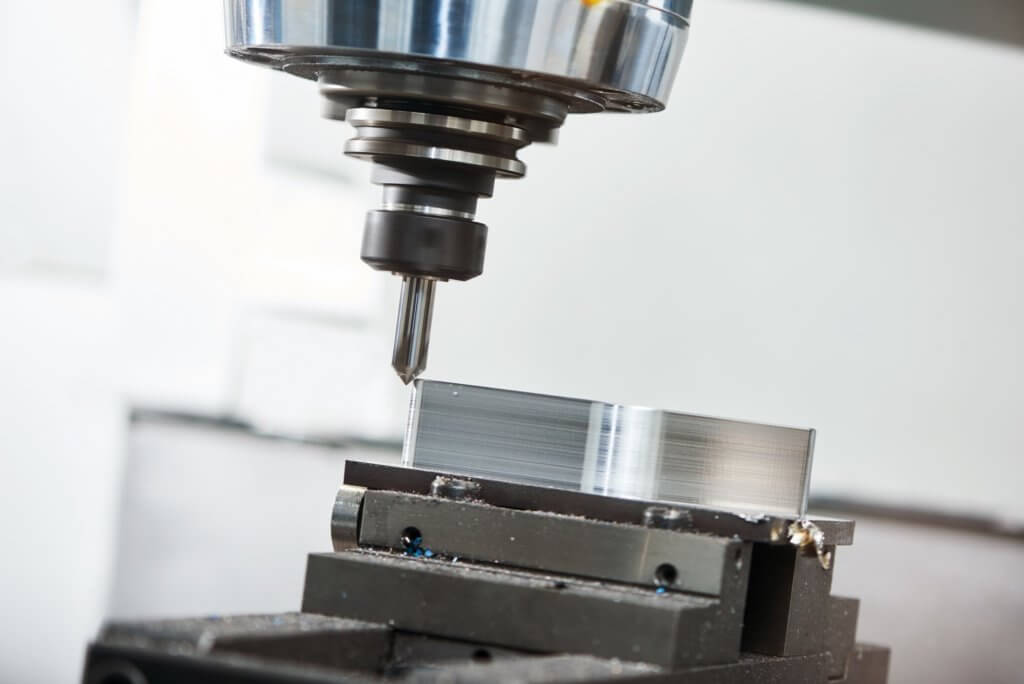

Acquiring complex machine tools is a major challenge, especially for small and medium-sized enterprises (SMEs). Leasing models support SMEs in the acquisition of such machine tools by replacing the high investment costs with lower, regularly recurring payments. Three parties are basically involved in such a leasing model: lessor, lessee and machine tool manufacturer. The basic idea is that the lessor purchases the machine tool from the manufacturer and then lets the lessee use it for a corresponding fee.

Pay-per-use approaches represent a further development of classic leasing. Here, the amount of the leasing rate is significantly influenced by the actual operating time of the machine tool – the longer it runs, the higher the leasing rate.

To read the full article in the EMO Future Insight series, visit: Pay-per-stress – how do leasing partners get their money’s worth?