Retaining value, conserving resources

A service life of 20 or 30 years is not uncommon for these machines. But in these times of retrofitting and remanufacturing, does it even make sense to talk of the “end of life”?

Strategies for transforming to the circular economy

Machine tools are valuable assets. The more expensive they are, the more reason there is to maintain them carefully, repair them if necessary, and keep them in the production process for as long as possible. A service life of 20 or 30 years is not uncommon for these machines. But in these times of retrofitting and remanufacturing, does it even make sense to talk of the “end of life”? – Although machine tools are already being held up as models for the modern circular economy, a lot of work still needs to be done to persuade stakeholders in the world of production technology. This applies to the ecological benefits of digital maintenance and servicing strategies, as well as to the realization that even very old units can be upgraded to high-tech machines in ways that conserve resources and make economic sense.

Climate and environmental targets as well as the scarcity of certain raw materials are now making a rethink necessary. This is also set to be discussed in the “Future of Sustainability in Production” trend topic at EMO Hannover 2023. Based on the current production technology methods, the manufacture of steel, aluminum, plastics and cement alone would generate about 800 gigatons of CO2 in the 21st century, calculates Prof. Dr. Holger Kohl, Deputy Director and head of the Corporate Management business unit at the Fraunhofer-IPK (Institute for Production Systems and Design Technology), Berlin. This would mean that the two-degree target of the Paris climate agreement would already have been missed. That is why it is so important for such materials to be recycled in some kind of circular economy, emphasizes Kohl, who is also a member of the German Academic Association for Production Technology (WGP). Conserving resources is the second major pillar of sustainable management, alongside the reduction of energy consumption.

The circular economy is about more than recycling

Unlike the currently prevalent linear economy in which products with relatively short lives are disposed of after use, the circular economy focuses on achieving the longest possible useful life followed by repair, reuse and recycling. Resources are kept in circulation and, if possible, used for new products. From a circular economy perspective, aspects such as maintenance and servicing aimed at extending service life, as well as the reuse and recycling of components and parts are of significant relevance for machine tools, claims Professor Kohl. There is no difference here between industry or science and research.

As a rule, machine tools, especially in the German-speaking countries, are already designed to give many years – if not decades – of trouble-free, high-precision and profitable operation. However, in the case of lathes. milling or grinding machines, the following also applies: “The amount of time it takes for the precision and reliability levels to diminish depends on the basic design of the machine, how heavily it is used and how well it is maintained,” explains Paul Kössl, Global Head of Business and Marketing at the international United Grinding Group, headquartered in Switzerland, which will be showcasing various brands at EMO Hannover 2023. The group, which employs around 2,500 people worldwide, relies on preventive maintenance to minimize downtimes and to extend the service life of its machines, Kössl points out. Preventive maintenance provides an insight not only into the current condition of the equipment, but also into the parts, processes and components that need to be repaired, replaced or upgraded in the near future. In addition, United Grinding is now increasingly offering digital products and assistance systems such as its “Service Monitor”, which centrally manages, monitors and documents maintenance tasks, including for multiple machines simultaneously.

Growing importance of digitalization

Digital assistance systems grew significantly in importance during the pandemic, says Paul Kössl. The number of remote maintenance calls alone more than tripled during this time. In the meantime, half of all United Grinding Group machines are now equipped with the new C.O.R.E. intelligent operating system, which enables data to be exchanged among machines, including with third-party systems, via the built-in umati interface. C.O.R.E. provides access to digital solutions in the machine itself, with no need to install additional hardware. For example, remote operation can be supported by a video conference using the camera integrated in the C.O.R.E. panel. Digitalization helps companies to work more precisely and closely in order to maintain their productivity and increase reliability levels, it is claimed. Kössl shares the view that the future is likely to embrace Big Data analyses, artificial intelligence and machine learning as the basis for predictive maintenance, even if many users still have major reservations about this. “But we’re already seeing a new generation of digital-native machine operators who are perfectly at home with using the associated technologies.”

Scientific research is also likely to make a contribution here. The BMBF (German Federal Ministry of Education and Research) is currently funding numerous projects along the value chain. These include projects dedicated to repair-friendly product design and the recovery of raw materials. Digitalization is seen as a key success factor for the circular economy. Digital technologies allow better networking among the relevant players. The projects funded so far include the Relife (Adaptive Re-Manufacturing for Life Cycle Optimization of Networked Capital Goods) project. According to the machine tool laboratory at RWTH Aachen University spearheading the project, this is basically an adaptive maintenance strategy that evaluates data from sensors to determine the optimum time and scope of maintenance measures. Technical, economic and ecological aspects are taken into account. Preventive re-manufacturing measures based on the sensor-monitored wear of components are proposed. This allows the aging machines to be kept at the technical level of a new machine, an approach that is also likely to spawn new business models.

“R” strategies for the second and third life

Researchers often talk about “R” strategies – Reduce, Reuse, Recycle – as basic principles. The R strategies form the basic framework for the transformation to a circular economy. The aims are to REDUCE the use of materials by not disposing of discarded products but selling them to third parties and REUSING them. In order to extend the useful life of products, they need to be REPAIRED so that they can return to fulfilling their function. REFURBISHMENT involves not only repairing the components, but also upgrading them to the current state of the art. RE-MANUFACTURING, by contrast, is the process of endowing a product with the same quality as a new one.

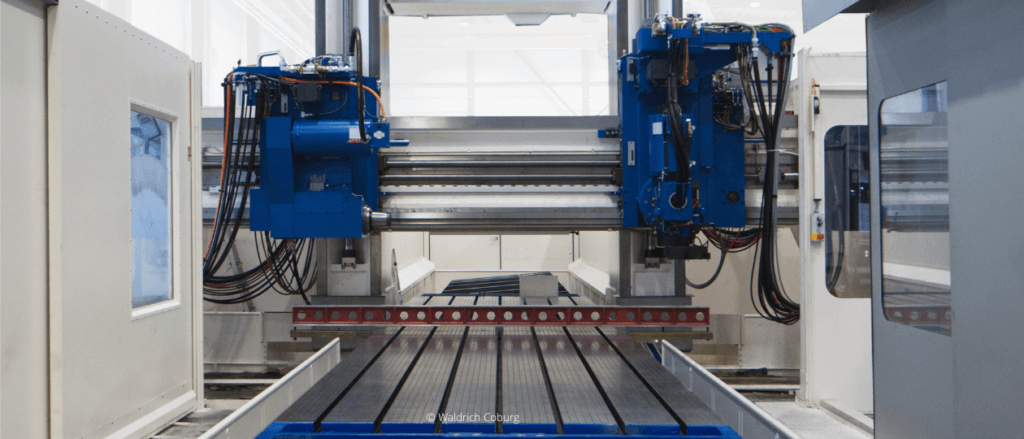

The general overhauling of machines represents an important branch of business for machine tool manufacturers. What can be achieved here is demonstrated by Waldrich Coburg which manufactures not only very large horizontal and vertical milling machines but also vertical lathes and grinding machines. Three machines are given a complete retrofit every year or so. As Retrofit Project Manager Steffen Nitzsche explains, the company already uses highly recyclable materials such as cast iron and steel for its products, thus reducing the consumption of natural resources. Very little plastic is used. The machines have hydrostatic guides that exhibit virtually no wear and are merely regarded as “well run in” after 30 or 40 years, the expert notes. For example, he describes a gantry milling machine which was built in 1981. The machine – with imposing floor plate dimensions of 3,600 mm x 13,500 mm, a passage width of 4,600 mm and a passage height of 3,500 mm – received a milling support system that was mechanically and electrically completely overhauled and modernized, and a modern gantry drive. All feed gears were also overhauled in the process. The machine was given a completely new electrical system as well as a modern Siemens 840D control unit, new axle drives, and hydrostatic and hydraulic components.

Overall, around 90 to 95 percent of a machine’s weight is retained during such retrofitting. The remaining 5 percent usually consists of control cabinet and cable materials. These are not disposed of either, but are handed over to an external service provider, and 30 to 40 percent of them reused.

“New from old” as an alternative to investing in new equipment

Matthias Helmprobst, Head of Control Technology at Waldrich Coburg, is keen to point out that it is not only possible to completely overhaul a machine that is 40 years or older, but also to upgrade it to the current state of the art. After the overhaul, the fact that the machine uses the latest control and computer technology in conjunction with the latest operating systems and safety architectures means that it also meets the current IT standards and can thus be integrated into the company network, for example. Depending on the scope of the work involved, the financial outlay for modernization ranges between 30 and 60 percent of the cost of a comparable new machine and is therefore often the more economical alternative.

At Waldrich Coburg, the topic of the circular economy is accorded a very high priority, emphasizes Matthias Helmprobst. In his view, whether or not it is implemented is based less on technical possibilities, but is rather a question of mentality. “A lot of people feel that a 40-year-old machine must be antiquated,” he says, adding: “We need to change such thinking if we want to move production forward in terms of the circular economy.”

Background

EMO Hannover 2023 – World’s Leading Trade Fair for Production Technology

International manufacturers of production technology will be presenting smart technologies for the entire value chain at EMO Hannover 2023 from 18 to 23 September 2023. Under the banner of Innovate Manufacturing, the world’s leading trade fair for production technology will showcase the entire range of modern metalworking technology which is at the heart of every industrial production process. The latest equipment will be on display, as will efficient technical solutions, product-related services, sustainable production methods and much more besides. The main focus of EMO Hannover is on cutting and forming machine tools, manufacturing systems, precision tools, automated material handling, computer technology, industrial electronics and accessories. EMO visitors come from all major industrial sectors including machine and plant construction, the automotive industry and parts suppliers, aerospace technologies, precision engineering and optics, shipbuilding, medical engineering, tool and mold making, steel and lightweight construction. EMO Hannover is the number one international meeting place for the industry. More than 2,200 exhibitors from 47 countries attracted nearly 120,000 trade visitors from around 150 countries at EMO Hannover 2019. EMO is a registered trademark of the European machine tool association Cecimo. EMO is organized by the VDW (German Machine Tool Builders’ Association), Frankfurt am Main, Germany.

Contacts

United Grinding Group Management AG

Inke Myschker

Manager Marketing Communications

Wankdorfallee 5

3014 Bern

Switzerland

Phone +41 31 356 0128

Werkzeugmaschinenfabrik Waldrich Coburg GmbH

Matthias Helmprobst

Head of Control Technology

Hahnweg 116

96450 Coburg

Germany

Phone +49 9561 65-323

matthias.helmprobst@waldrich-coburg.de

Cornelia Gewiehs

Große Straße 35

27356 Rotenburg

Germany

Phone +49 4261 1663

gewiehs@communicate-pr.de

Press Material:

Pictures:

Image 04: Example of a 40+ year-old gantry milling machine before…

Image 05: …and after modernization.

Image 06: Example of a 40+ year-old grinding ma-chine before…

Image 07: …and after modernization.